November 04, 2024: Lean Six Sigma (LSS), a methodology developed to improve efficiency and quality, is a powerful approach for increasing value in an organization. It is experiencing a resurgence in 2024 as businesses face complex economic and operational challenges. Despite being overlooked in recent years, LSS remains a powerful tool for continuous improvement, especially when combined with advanced analytics, AI, and agile methodologies. As more manufacturing organizations adopt LSS – and more manufacturing organizations are being reshored in North America – those in accounting and finance roles can make sure the full value of these initiatives is realized when they understand the concepts and speak the language of LSS. A quick background …

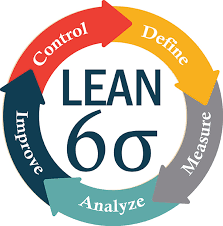

LSS can be viewed in five stages – Define, Measure, Analyze, Improve, and Control, which are often referred to simply as DMAIC. It is bottom-line driven, focusing on financial outcomes that accountants and finance professionals inherently understand. The finance area is often required in LSS projects, whether by providing data or driving initiatives. LSS’s holistic approach to problem-solving resonates with accountants and finance professionals, as it avoids departmental silos and integrates people, processes, and technology. This has the potential to position their department as leaders rather than just supporters.

Levels of LSS Proficiency

But to what level should an accountant or finance professional be versed in LSS? LSS actually has a vocabulary that provide guidance in answering this question for organizations – Yellow Belt, Green Belt, and Black Belt (and for very large organizations, Master Black Belt).

- Yellow Belt: A Yellow Belt possesses a basic understanding of LSS. These professionals understand the vocabulary of LSS and can hit the ground running in supporting projects led by Green or Black Belts. Because of their LSS training, they can identify process improvement opportunities and contribute to making processes more efficient.

- Green Belt: A Green Belt (GB) possesses a good understanding of all aspects of the phases of DMAIC. They often operate under the supervision and guidance of the Black Belts, analyzing and solving quality related issues. Unlike Black Belts, who lead cross-functional projects, GBs usually work on projects within their own functional area.

- Black Belt: A Black Belt professional has a high level of understanding of LSS, including supporting systems and tools & techniques. They exhibit team leadership as a problem solver, maintain team dynamics, allocate team members’ roles and responsibilities, and act as a change agent in transformational, organization-wide LSS projects. They lead and coach cross-functional Green and Yellow Belt teams in LSS projects.

- Master Black Belt: These individuals are responsible for translating the high-level business goals into an LSS strategy for the organization and the supporting tactics. They lead the development of the LSS skills in the organization, from Yellow to Black Belt. Master Black Belts have the ultimate responsibility to ensure the quality, value, and sustainability of LSS projects in their organization.

LSS Project Types

LSS can be applied to an array of project types, from traditional manufacturing applications to emerging value-creating activities required to compete in today’s complex operating environment defined by increasing government and environmental constraints. Because LSS is based on the articulation of SMART goals (specific, measurable, achievable, realistic, and timely), it is easy to see the results of LSS projects in terms of ROI. Some traditional applications of LSS projects might include:

- Increasing First Run Parts From 60% to 90%

- Reducing Bent/Scratched/Damaged (BSD) Scrap for Building Envelopes

- Reducing Lead Time in Customer Replacement Part Orders by 41%

- Reducing Learning Curve Ramp for Temp Employees by 2 Weeks

- Increasing Daily Meat Production in a Processing Plant by 25%

A LSS approach is increasingly being applied to emerging opportunities and challenges that define today’s operating imperatives:

- Green Lean Six Sigma (GLSS): GLSS is emerging as a critical approach for organizations aiming to meet sustainability, environmental, social, and governance (ESG) goals. By reducing waste and conserving resources, LSS can help companies comply with new regulations and meet public expectations for sustainability.

- Supply Chain Resilience: The COVID-19 pandemic and global tensions have highlighted the importance of supply chain resilience. LSS’s DMAIC framework can help organizations identify pain points and optimize supply chain processes. While extreme “just-in-time” strategies may be declining, LSS remains vital for ensuring supply chain agility and visibility.

- Industry 4.0: As manufacturers adopt Industry 4.0 technologies like the Internet of Things (IoT) and AI, LSS can play a crucial role in ensuring successful implementation by providing the structured data and standardized processes needed. Although the integration of LSS and Industry 4.0 is still in its early stages, it offers significant potential for improving quality, efficiency, and sustainability.

The LSS Case for Accounting and Finance

Accountants and auditors are uniquely positioned to excel with LSS due to their comprehensive view of operations, access to data, and strategic involvement. They see beyond individual departments, making them ideal for initiating and implementing organizational changes. Their natural focus on accuracy, control, and structure aligns well with LSS’s methodology, which emphasizes measurable improvements and process efficiency.

Accountants have the data necessary for LSS projects, enabling them to measure success in financial terms, which is critical for evaluating the return on investment. They are also integral to strategic planning, ensuring that LSS projects align with corporate goals. The structured approach of LSS is familiar to accountants, making it easier for them to adopt and apply its techniques.

As organizations increasingly hold accountants to non-financial performance metrics, LSS offers a way to enhance efficiency and effectiveness. Furthermore, LSS can help accountants and auditors enhance their professional image, demonstrating their ability to think innovatively and contribute to broader organizational goals, while also mitigating risks through a structured, reliable methodology.

If you would like to learn how your accounting and financing professionals can employ LSS to contribute to adding further value to your organization, contact Peter McAliney at Professional and Executive Education at Rutgers (PEER) – peter.mcaliney@rutgers.edu or visit the PEER website to learn about the programs Rutgers offers in LSS.